Quote & Buy

Car Insurance

Home Insurance

Business Insurance

Other Products

Get a car insurance

Get a car insurance

QUOTE ONLINE,

IN MINUTES!

QUOTE ONLINE,

IN MINUTES!

Products designed for your budget

Why join Budget?

Save up to R420pm when you switch to Budget

Cash Back after just

2 years

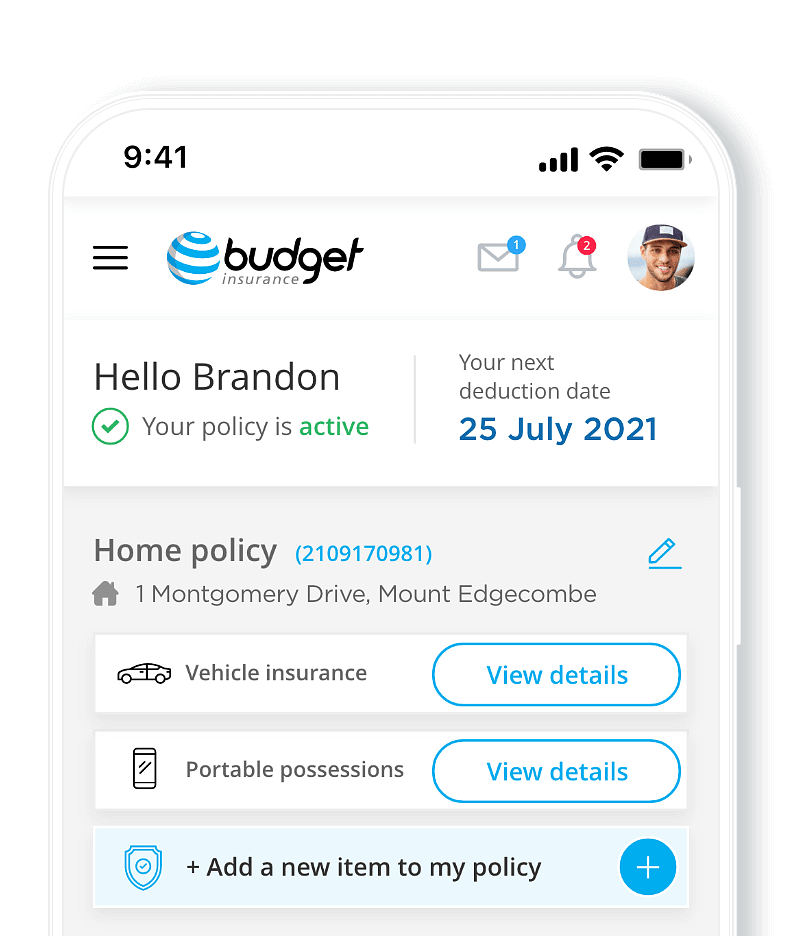

Skip the call centre queues and manage your policy online

Skip a premium every year with payment holiday

What our customers say

Independent Service Rating Based on 84 verified reviews. Read all reviews.

What our customers say

Independent Service Rating Based on 84 verified reviews. Read all reviews.

Why join Budget?

Save up to R420pm when you switch to Budget

Cash Back after just

2 years

Skip the call centre queues and manage your policy online

Skip a premium every year with payment holiday

Other insurance products on offer

Insurance for bikes

Let us worry about keeping your bike covered, so you can focus on the road.

Insurance for buildings

The structure of your home is vulnerable to risks that could easily damage it. Let us cover your structures.

Legal cover

This is a policy that includes three main benefits: the Basic Benefit, Mediation Benefit, and the Litigation Benefit.

Life insurance cover

This policy provides cover for the funeral expenses in the event of your death or that of your spouse or children.

Personal loans

This is exactly why Budget has made sure that you can get a Budget Personal Loan* of up to R250 000.

4x4 Insurance

Get affordable 4X4 Insurance quotes tailored specifically for your off-road vehicle with Budget

Insurance for bikes

Let us worry about keeping your bike covered, so you can focus on the road.

Insurance for buildings

The structure of your home is vulnerable to risks that could easily damage it. Let us cover your structures.

Legal cover

This is a policy that includes three main benefits: the Basic Benefit, Mediation Benefit, and the Litigation Benefit.

Life insurance cover

This policy provides cover for the funeral expenses in the event of your death or that of your spouse or children.

Personal loans

This is exactly why Budget has made sure that you can get a Budget Personal Loan* of up to R250 000.

4x4 Insurance

Get affordable 4X4 Insurance quotes tailored specifically for your off-road vehicle with Budget